Power Of Attorney Irs, Irs Power Of Attorney Form For Business Fresh General Power Attorney Form Kansas Unique Durable Power Attorney Models Form Ideas

Power of attorney irs Indeed lately has been hunted by consumers around us, perhaps one of you personally. People are now accustomed to using the internet in gadgets to view image and video information for inspiration, and according to the name of this article I will discuss about Power Of Attorney Irs.

- All About Irs Form 2848 Smartasset

- Free Irs Power Of Attorney Form 2848 Revised Jan 2018 Pdf Eforms Free Fillable Forms

- Irs Tax Attorney Information And Pointer Worrying Power Of Attorney

- Irs Form 2848 Report Power Of Attorney Internal Revenue Service

- Https Www Irs Gov Pub Irs Tege 2848 8821 Phoneforum Handout Pdf

- Irs Form 709 And Durable Power Of Attorney Fill Online Printable Fillable Blank Pdffiller

Find, Read, And Discover Power Of Attorney Irs, Such Us:

- 32 3 2 Letter Rulings Internal Revenue Service

- 2020 Form Irs 2848 Fill Online Printable Fillable Blank Pdffiller

- Learn How To Fill The Form 2848 Power Of Attorney And Declaration Of Representative Youtube

- Form 2848 Power Of Attorney And Declaration Of Representative Irs Free Download

- Power Of Attorney New York Statutory Short Form 2017 Unique Power Attorney Form Mississippi Elegant Top Result Irs Form 2848 Models Form Ideas

- Epithelioid Mesothelioma Medical

- Mesothelioma Popeyes Meme

- Law Company Profile

- Simmons Beautyrest Classic Firm

- Grinch Coloring Pages For Kids

If you re looking for Grinch Coloring Pages For Kids you've reached the ideal place. We have 100 images about grinch coloring pages for kids including images, photos, photographs, backgrounds, and much more. In these page, we also have number of images out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

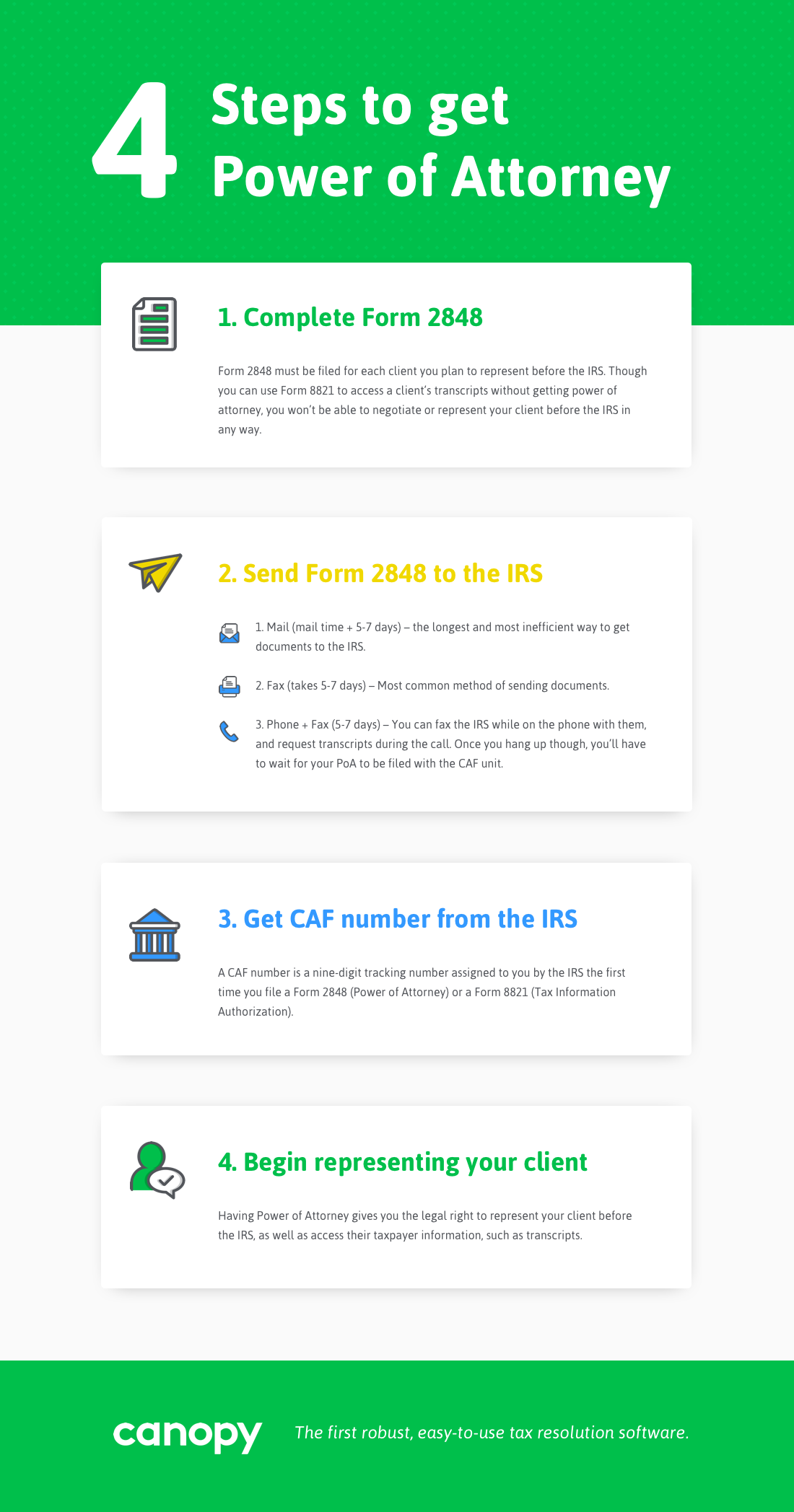

If you want to revoke a previously executed power of attorney and do not want to name a new representative you must write revoke across the top of the.

Grinch coloring pages for kids. The substitute form must contain all of the information required on the irs form. Power of attorney and declaration of representative 0220 02132020 inst 2848. Practice before the irs and power of attorney 0218 02262018 publ 947 sp practice before the irs and power of attorney spanish version 0218 07202020 form 2848.

A general power of attorney is not enough. Have you completed a form 2848 and attached it to your application. Irs power of attorney for a corporation requires a signature from an organization officer with authority to bind the taxpayer.

See substitute form 2848 later for information about using a power of attorney other than a form 2848 to authorize an individual to represent you before the irsthe individual you authorize must be eligible to practice before the irs. The irs allows substitute power of attorney forms with strict requirements. The person authorized in this filing must be an eligible.

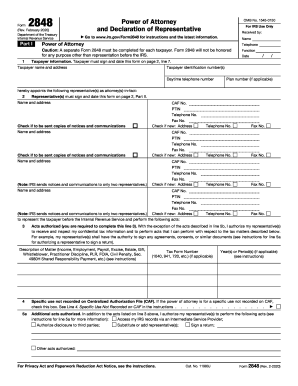

Form 2848 is used to authorize an eligible individual to represent another person before the irs. You must complete a form 2848 pdf power of attorney and declaration of representative authorizing the individual to represent you. 947 practice before the irs and power of attorney.

If this declaration of representative is not completed signed and dated the irs will return power of attorney. Revocation of power of attorney withdrawal of representative. Irs form 2848 is used to designate an individual to represent the taxpayer before the irs and to allow the representative to perform all tax acts that the taxpayer would normally take care ofform 2848 is used to file for irs power of attorney.

Use form 2848 to authorize an individual to represent you before the irs. Internal revenue service is limited by section 103e. The irs power of attorney form 2848 is the document required well sort of see below in order to represent a taxpayer in front of the irsthere are some common misconceptions about this form that we would like to lay to rest.

Your representative must also attach a form 2848 without your signature for irs tracking purposes. Instructions for form 2848 power of attorney and declaration of representative. You have to be an attorney to operate under an irs power of attorney.

More From Grinch Coloring Pages For Kids

- Organoids Mesothelioma

- New York Law Offices

- Most Common Cause Of Mesothelioma

- Niosh Firefighter Mesothelioma

- High Resolution Ct Of The Lung Mesothelioma

Incoming Search Terms:

- Form 2848 Instructions For Irs Power Of Attorney Community Tax High Resolution Ct Of The Lung Mesothelioma,

- 3 21 263 Irs Individual Taxpayer Identification Number Itin Real Time System Rts Internal Revenue Service High Resolution Ct Of The Lung Mesothelioma,

- International Power Of Attorney Fill Out And Sign Printable Pdf Template Signnow High Resolution Ct Of The Lung Mesothelioma,

- Purpose Of Irs Form 2848 How To Fill Instructions Accounts Confidant High Resolution Ct Of The Lung Mesothelioma,

- Why A Power Of Attorney Is Sometimes Needed For Your Tax Pro High Resolution Ct Of The Lung Mesothelioma,

- Obtaining A Power Of Attorney Through Irs E Services High Resolution Ct Of The Lung Mesothelioma,