Credit Cleaning Attorney Letters, Why You Should Remove Old Addresses Incorrect Names From Credit Reports Tier One Credit

Credit cleaning attorney letters Indeed lately is being hunted by users around us, maybe one of you. People now are accustomed to using the internet in gadgets to see video and image information for inspiration, and according to the name of this post I will talk about about Credit Cleaning Attorney Letters.

- Debt Validation Letter Credit Repair Secrets Exposed Here Credit Repair Credit Repair Letters Check Credit Score

- 3

- Send You Attorney Written Credit Repair Letters For 2020 By Legalpros

- Credit Repair Companies Offer To Fix Your Credit For A Fee Are They A Scam Huffpost Life

- Do 609 Credit Repair Dispute Letters Really Work

- Learn How To Repair Your Credit For Free Consolidated Credit

Find, Read, And Discover Credit Cleaning Attorney Letters, Such Us:

- Method Of Verification Sample Letter 2020 S Updated Template Guide

- How To Remove All Negative Items On Your Credit Report Creditbrite Com

- Credit Repair Companies Offer To Fix Your Credit For A Fee Are They A Scam Huffpost Life

- Debt Validation Letter Why It Could Land You In Hot Water

- Jamming Cleans Your Credit Temporarily Fox Business

- Pm Law Firm

- Pleurodesis Mesothelioma Treatment

- What Is Stage 4 Mesothelioma

- Mrs Meyers Lavender Soap

- Unicorn Colouring Free

If you re looking for Unicorn Colouring Free you've reached the ideal location. We ve got 104 graphics about unicorn colouring free including images, pictures, photos, backgrounds, and more. In these web page, we also provide variety of images available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

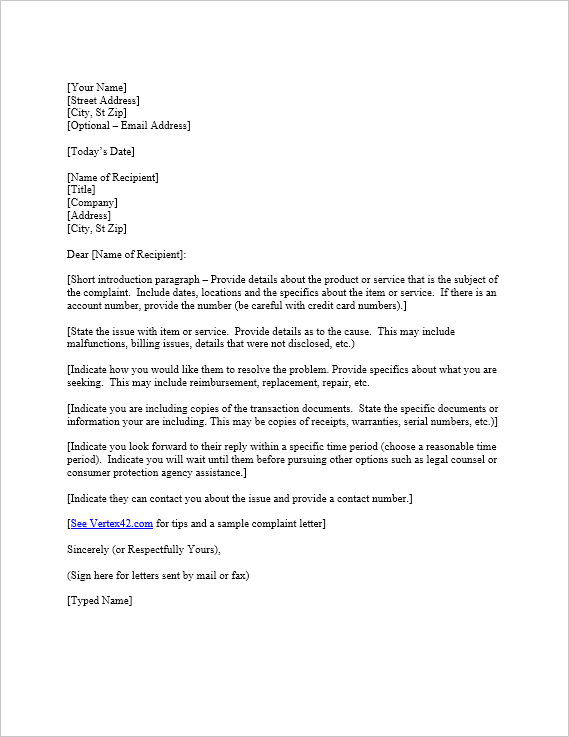

This attorney written credit repair kit is direct to the point to get the results you wanteverything you need to dispute and win against both creditors and credit bureaus.

Unicorn colouring free. You should always consult a lawyer when drafting a credit dispute letter that can have a lasting impact on your credit. This useful guide will navigate you through several credit repair strategies. Credit report dispute letter use this credit dispute letter to send to all three credit reporting agencies when disputing inaccurate incorrect or incomplete information found on your credit reports.

Basic credit dispute letter this letter is a shorter version of the original credit dispute letter that shows you how to list multiple disputed items. Collection agency dispute. You will receive over 10 attorney written letters.

Still you should still be familiar with the process on your own. However if you are attempting to find some debt relief you may want to start by sending a. We will give you tips on when and how to use them.

We will also give you links to sample letters and templates you can use to get started. If the agencies leave any errors incorrect by the end of their investigation period consumers can file a lawsuit against them to get the credit report fixed. A consumer may believe that their credit report is inaccurate and the inaccuracies are damaging their ability to use credit.

You should also take the time to read the fair credit reporting act fcra section 611 on the federal trade commission ftc website. Credit bureaus are responsible for ensuring complete accuracy on consumers credit reports. You have the right to contact the consumer reporting company and the information provider if any incomplete inaccurate erroneous misleading outdated or unverifiable information has been provided to a consumer reporting company by any person company or organization.

Credit reports and credit scores are designed to help lenders. Any errors found on credit reports can be disputed by sending credit repair letters to the credit reporting agencies. In this event it is necessary to write a clean credit letter to remove the inaccuracies so the credit report is clean and the credit score will go up.

Step by step instructions and user guide. If you are looking for a comprehensive collection of credit repair sample letters you have come to the right place.

More From Unicorn Colouring Free

- Monster Jam Coloring Pages Grave Digger

- Preschool Martin Luther King Jr Coloring Page

- Treece Law Firm

- Paw Patrol Coloring Pages

- Free Printable Crayon Coloring Pages

Incoming Search Terms:

- Fair Credit Reporting Act Fcra Dispute Lawyers Free Printable Crayon Coloring Pages,

- Https Support Creditrepaircloud Com Wp Content Uploads 2016 08 The Ultimate Guide To Starting A Credit Repair Business Pdf Free Printable Crayon Coloring Pages,

- The Truth About Credit Repair Credit Com Free Printable Crayon Coloring Pages,

- Rapid Results Credit Repair Credit Dispute Letter System Credit Rating And Repair Book Kindle Edition By Harris John Professional Technical Kindle Ebooks Amazon Com Free Printable Crayon Coloring Pages,

- Credit Repair Letter Credit History Credit Bureau Free Printable Crayon Coloring Pages,

- Beware Of Credit Repair Companies Consumer Watchdogs Say The New York Times Free Printable Crayon Coloring Pages,